Hedge Funds >

DyKa Investments Magnolia Fund

Discretionary Long-Oriented Multi-Asset Fund

*Formerly “DyKa Investments Capital Appreciation Fund”

Updated as of 5/20/2025

Key Facts

Fund Management

DyKa Investments, LP

Minimum Investment

$1,000

Expense Ratio

1.00%

Net Assets

Benchmark

Holdings

Management

Asset Class

Benchmark

$13,000

None

40

Active

Long-Oriented Multi-Asset

HFRI Fund Weighted Composite Index

DIGVX

High Water Mark

Yes

Redemptions

90 Days

Hurdle Rate

Yes, 8%

Brokerage

Robinhood Markets, LLC

Custodian

Frontier Bank, Inc

Distributor

In-House

Strategy >

The Funds Objective

Our fund employs a Multi-Asset, risk-adjusted return approach, prioritizing capital appreciation and growth through a fundamentally driven investment process. While equities form the core of our portfolio, we maintain a diversified allocation across bonds, private credit, and global macro strategies to enhance stability and optimize risk-adjusted returns. Our equity investments focus on high-conviction opportunities across various sectors, leveraging deep fundamental analysis to identify companies with strong financials, competitive advantages, and scalable growth potential. Fixed income and private credit allocations provide downside protection and yield enhancement, while global macro strategies allow us to capitalize on macroeconomic trends, geopolitical shifts, and market dislocations. This balanced sector allocation enables us to navigate diverse market conditions while maintaining an opportunistic yet disciplined approach to portfolio construction.

At DyKa Investments, our Multi-Asset Growth and Income Fund is designed to deliver consistent long-term performance by balancing capital appreciation with steady income. The fund targets a diverse mix of asset classes to pursue growth through equity upside and generate income through high-quality yield-bearing investments.

This strategy is built for investors seeking a total return approach—one that combines the power of compounding capital gains with regular income distributions, all while managing risk across market cycles.

Multi-Asset Approach

We allocate across a broad spectrum of asset classes to capture opportunities and diversify risk:

Equities – for long-term capital growth, emphasizing high-conviction, fundamentally sound companies

Fixed Income & Credit – for reliable yield, including investment-grade bonds, high-yield credit, structured credit, and select private debt

Alternatives & Thematic Positions – for uncorrelated returns and tactical opportunity, including convertible bonds, preferreds, REITs, and macro themes

This flexibility allows the portfolio to adapt across environments, tilt toward opportunity, and maintain resilience during volatility.

Growth & Income Dual Mandate

Capital Appreciation: We seek growth through high-quality equities and thematic investments with scalable business models and long-term tailwinds.

Income Generation: We aim to produce stable yield by targeting bonds, structured credit, and income-producing alternatives with attractive risk-adjusted return profiles.

Each position must justify its place through either return potential, income contribution, or both.

Fundamentals First

Every investment starts with rigorous fundamental analysis. We prioritize:

Strong balance sheets

Consistent free cash flow

Sustainable competitive advantages

Reasonable valuations and risk-adjusted upside

By grounding every decision in bottom-up financial research, we avoid fads and maintain long-term discipline in portfolio construction.

24.05%

Annualized Return

38.78%

Annualized TWR

25.71%

6.58%

100.00%

40.00%

20.00%

0.00%

Annualized Return >

IRR

YTD

90.88%

Total Return

1.01

Sharpe Ratio

Return Numbers and figures are updated at end of trading day - monthly.

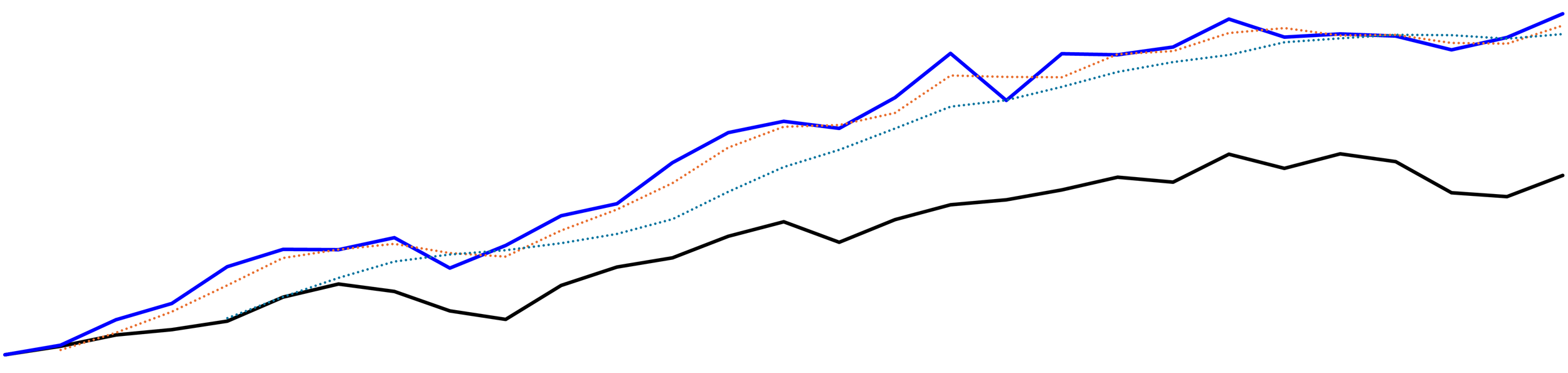

Fund Growth

Time Weighted Return Growth ( Blue ) v. SPX

80.00%

60.00%

2023

DyKa Capital Appreciation

S&P 500

Nasdaq 100

Dow Jones

YTD

6.58%

2024

1 Year

3 Year

2025

5 Year

All Time

Cumulative Return >

DyKa Capital Appreciation

S&P 500

Nasdaq 100

Dow Jones

1.40%

2.10%

0.60%

YTD

6.58%

8.01%

11.60%

9.10%

7.00%

2024

24.50%

7.90%

14.60%

4.40%

2023

-

13.90%

22.00%

8.10%

2022

DIGVX

SPX

24.50%

10.20%

14.10%

All Time

1.92%

2.37%

1.24%

33.91%

25.02%

25.88%

14.99%

33.74%

26.26%

55.13%

16.18%

-

(18.11%)

(32.28%)

(6.86%)

10.90%

90.88%

31,676.00%

7,174.00%

96,108.00%

Core Elements of Our Risk Framework

1. Strategic Diversification

We spread risk across asset classes, sectors, and geographies to avoid over-concentration. The fund includes equities, fixed income, alternatives, and tactical exposures. Each holding must contribute to return without introducing excessive correlation or downside sensitivity.

2. Fundamental Conviction with Position Sizing

Every investment begins with deep research. High-conviction positions are sized based on their risk profile, liquidity, volatility, and potential asymmetry. Lower-conviction or higher-risk ideas are kept small or paired with hedges.

3. Active Monitoring and Exposure Management

We track net and gross exposure, beta, and volatility in real time. This helps us understand how the portfolio behaves under different market conditions. We adjust allocations proactively when we see risk concentrations building.

4. Risk/Reward Discipline

We continuously evaluate each position's upside potential relative to its downside risk. If the risk-reward profile deteriorates, we reduce or exit the position—even if the fundamentals are still strong.

5. Scenario and Stress Testing

We use hypothetical scenario models to understand how the portfolio would react to market shocks, macro events, or rate movements. This ensures our positioning remains resilient during uncertainty.

6. Embedded Hedging and Defensive Tools

The fund may tactically use cash buffers, inverse ETFs, volatility products, or bond duration shifts to reduce drawdown risk. We do not rely on market timing but implement targeted risk reduction strategies when appropriate.

Beta

0.11

Sortino Ratio

Leverage Ratio

Return/Drawdown Ratio

Risk Profile

1 Year

1.00

3 Year

All Time

Standard Deviation

1 Year

2.26

Gain-To-Pain Ratio

1.26

3 Year

All Time

18.48%

Sharpe Ratio

1 Year

Alpha

1 Year

5.20%

1.26

19.55%

All Time

Max Drawdown FY25

3.67

0.27

1.84

19.55%

3 Year

1.01

1.01

3 Year

All Time

6.50%

6.50%

(13.06%)

Turnover Ratio

6.69%

R-Squared

58.19%

Expenses & Yield

Management Fees

Performance Allocation

Subject to Hurdle Rate and HWM

Total Expense Ratio ( Before Carry )

1.00%

15.00%

1.00%

As of current PPM

Income Yield

Fund Holding Expenses

Fund Expenses ( Management Fee )

Income Yield ( Net Expenses )

1.94%

(0.06%)

(1.00%)

0.88%

Portfolio Managers >

Dylan Karnish

Founder & CEO / CIO

Management

Fund Manager Biography

Dylan Karnish is the Founder and Chief Investment Officer of DyKa Investments, a multi-strategy investment firm focused on delivering strong, risk-adjusted returns across public markets, private credit, and alternative asset classes. Dylan launched DyKa in 2023 with the vision of building a research-driven, innovation-focused fund that blends long-term capital appreciation with consistent income generation.

Drawing from his background in finance and accounting, Dylan oversees all investment strategy, portfolio construction, and risk management across the firm’s flagship funds, including the DyKa Capital Appreciation Fund and the DyKa Enhanced Income Fund. His approach combines deep fundamental research with macroeconomic insight, applying a flexible, multi-asset framework designed to navigate changing market conditions.

Prior to founding DyKa, Dylan held a full-time accounting and financial operations role at a private company while pursuing his Finance and Accounting degree at the University of Nebraska–Lincoln. He also served in leadership roles at the Big Red Investment Club and Phi Kappa Psi fraternity, where he developed a foundation in capital markets and investor relations.

Dylan manages DyKa with a commitment to disciplined research, transparent investor communication, and long-term value creation. His ambition is to build DyKa into an institutional-grade investment platform capable of serving individual investors, family offices, and eventually public and private institutions across the country.